- Jan 15, 2026

Share this post on:

Artificial Intelligence (AI) is revolutionizing various industries, and the banking sector is no exception. The impact of AI in banking is transformative, leading to improved efficiency, enhanced customer experience, and increased profitability. AI refers to the simulation of human intelligence processes by machines, especially computer systems. These processes include learning, reasoning, problem-solving, perception, and language understanding. In banking, AI is used to automate routine tasks, enhance decision-making, and personalize customer experiences.

According to a report by PwC, the banking industry is expected to save over $1 trillion by 2030 through the implementation of AI technologies. This significant cost reduction will encourage banks and financial institutions to invest in smart fintech solutions, ultimately shaping the future of banking.

Key Takeaways

Artificial Intelligence enables banks to automate processes, deliver 24/7 customer support, and offer highly personalized financial services.

AI systems analyze large volumes of data in real time to detect fraudulent activities, reduce financial risk, and improve credit decision-making.

By automating repetitive tasks and streamlining back-office operations, AI helps banks reduce errors, improve productivity, and lower operational costs.

Successful AI adoption requires responsible governance, transparent algorithms, and strict compliance with data protection and financial regulations.

Banks that strategically invest in AI will gain a competitive advantage by delivering smarter, faster, and more secure financial services.

Application of AI in Banking

Artificial Intelligence (AI) is revolutionizing the banking industry by providing new and innovative ways to serve customers, streamline operations, and manage risk. Here are some of the key areas where AI is being applied in banking:

1. Customer Service

AI-powered chatbots and virtual assistants are being used to provide 24/7 customer support, answer common questions, and guide users through various processes such as opening an account or applying for a loan. These tools can handle a high volume of queries simultaneously, freeing up human agents to focus on more complex issues.

AI is also being used to personalize the customer experience by analyzing individual behavior and preferences. For example, AI algorithms can analyze a customer’s transaction history to recommend relevant products and services or use natural language processing to understand the sentiment behind customer interactions and provide tailored responses.

2. Fraud Detection and Prevention

AI is being used to detect and prevent fraud by analyzing patterns and anomalies in transaction data. Machine learning algorithms can be trained to identify suspicious behavior, such as unusual spending patterns or login attempts from unfamiliar locations. Once a potential threat is detected, the system can alert the bank or take automated action to prevent the fraud from occurring.

AI can also be used to verify the identity of customers by analyzing their behavior during online sessions. This can include monitoring how they interact with the website or app, such as the speed at which they type or move their mouse, to ensure that it matches their usual pattern of behavior.

3. Risk Management

AI is being used to help banks make better decisions about lending and investment by analyzing vast amounts of data to identify patterns and trends. For example, machine learning algorithms can be used to analyze a borrower’s credit history, employment status, and other factors to predict their likelihood of defaulting on a loan. This information can then be used to make more informed lending decisions and reduce the risk of default. Combining AI with loan management enables financial institutions to streamline the entire lending process, from risk assessment to repayment tracking, improving both efficiency and decision-making.

AI is also being used to analyze market data and identify trends that can inform investment decisions. For example, machine learning algorithms can be trained to analyze historical data on stock prices,

economic indicators, and other factors to predict future trends and identify investment opportunities.

4. Operational Efficiency

AI is being used to automate various processes in banking, such as data entry, document processing, and compliance checks. This can help reduce errors, increase efficiency, and lower costs. For example, machine learning algorithms can be used to extract data from documents such as invoices and contracts, reducing the need for manual data entry.

AI is also being used to optimize trading strategies by analyzing market data in real time and making automated trades based on predefined rules. This can help banks make faster and more accurate trades, reducing the risk of losses due to market volatility.

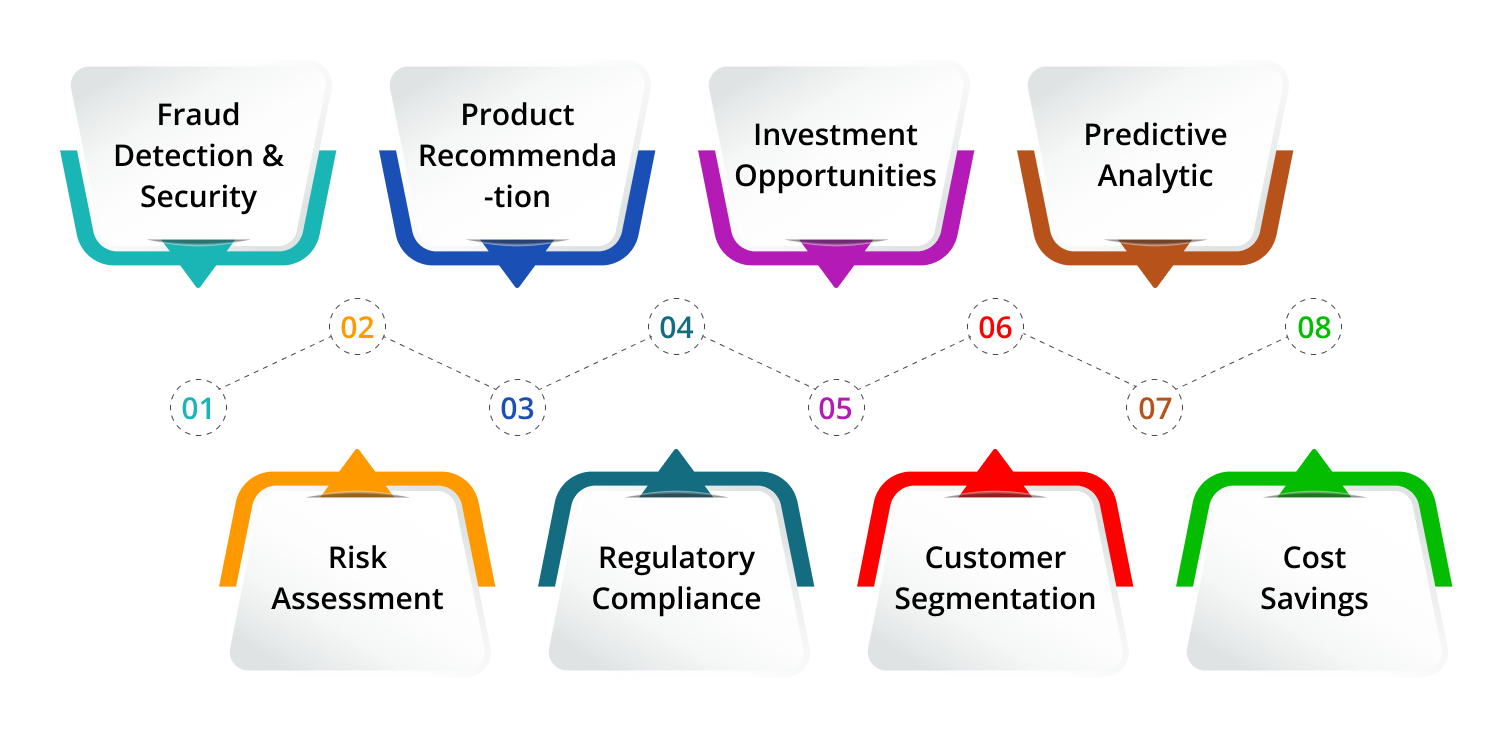

Benefits of AI in Banking

Artificial Intelligence (AI) is revolutionizing various industries, and banking is no exception. The implementation of AI in banking offers numerous benefits, including:

Improved Customer Experience: AI-powered chatbots and virtual assistants can provide 24/7 customer service, answering queries instantly and accurately. They can also offer personalized financial advice based on the customer’s spending patterns and financial goals.

Fraud Detection and Security: AI can analyze patterns and anomalies in transactions to detect fraudulent activities in real time. It can also strengthen security by verifying identities through biometric authentication, such as voice, facial, or fingerprint recognition. Paired with expense report software, AI can further reduce fraud while improving financial reporting accuracy.

Risk Assessment: AI can analyze vast amounts of data to assess credit risk and make accurate predictions about a borrower’s ability to repay a loan. This can help banks make informed lending decisions and reduce the risk of default.

Operational Efficiency: AI can automate routine tasks, such as data entry and customer verification, reducing manual errors and increasing efficiency. It can also help in predictive maintenance of banking infrastructure, reducing downtime and maintenance costs.

Product Recommendation: AI can analyze a customer’s financial behavior and recommend products that meet their needs. This can increase customer satisfaction and loyalty.

Regulatory Compliance: AI can help banks comply with regulations by automatically monitoring and reporting suspicious activities. It can also help in model validation, ensuring that the bank’s risk models are accurate and up-to-date.

Investment Opportunities: AI can analyze market trends and provide insights into potential investment opportunities. This can help banks offer better investment products to their customers.

Customer Segmentation: AI can analyze customer data to segment customers based on their behavior, preferences, and needs. This can help banks tailor their marketing strategies to different customer segments, improving their effectiveness.

Predictive Analytics: AI can analyze historical data to predict future trends and events. This can help banks anticipate customer needs and adjust their strategies accordingly.

Cost Savings: By automating routine tasks and improving efficiency, AI can help banks save costs.

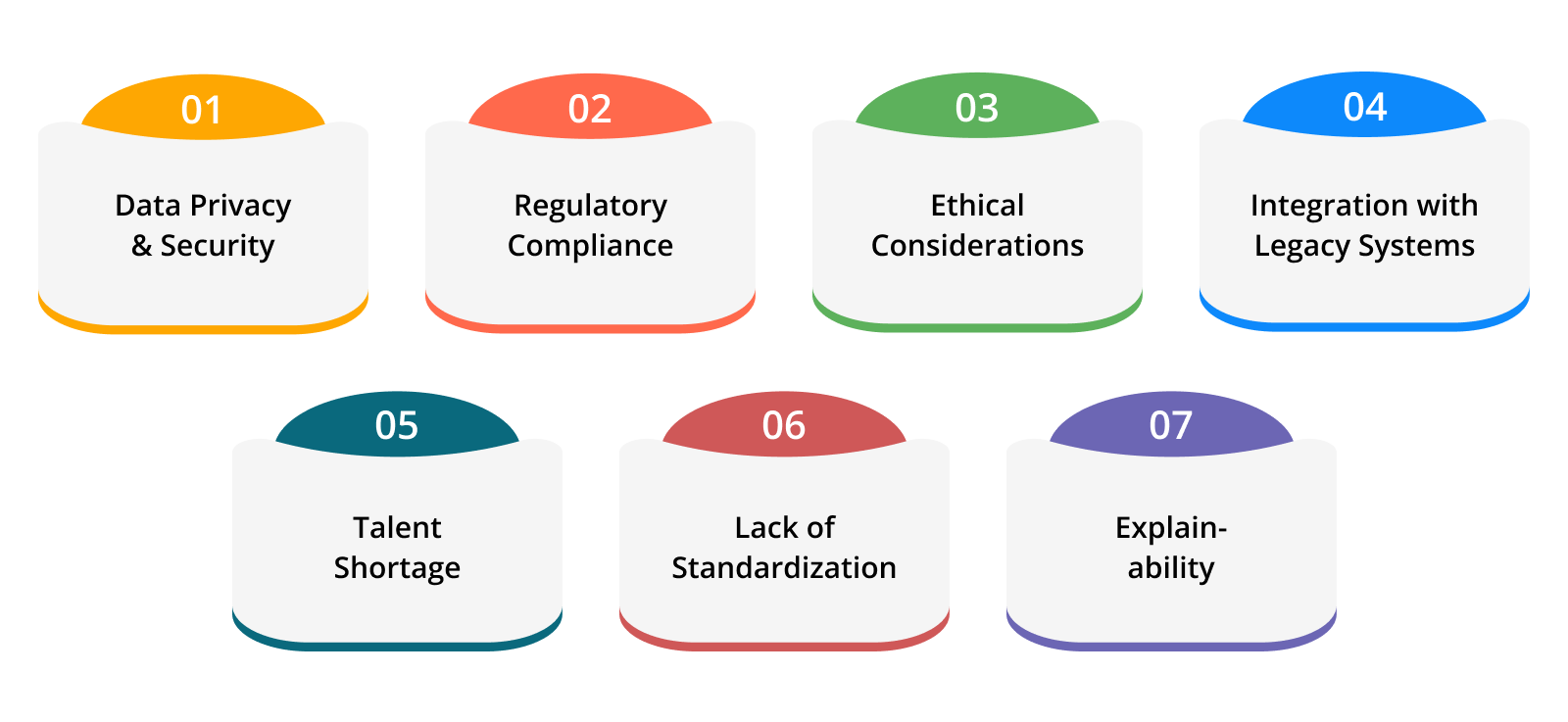

Challenges of AI in Banking

Artificial Intelligence (AI) has the potential to revolutionize the banking industry by automating processes, improving customer experience, and identifying new revenue opportunities. However, the adoption of AI in banking is not without its challenges. Here are some of the major hurdles that the banking industry must overcome to fully leverage the potential of AI.

Data Privacy and Security

One of the biggest challenges facing the adoption of AI in banking is ensuring data privacy and security. Banks possess vast amounts of sensitive customer data, making them attractive targets for cybercriminals. AI systems require access to this data to function effectively, which increases the risk of data breaches. Therefore, banks need to invest in robust cybersecurity measures and ensure compliance with data protection regulations to protect customer data and maintain trust.

Regulatory Compliance

AI systems can help banks comply with regulatory requirements by automating compliance tasks and detecting suspicious activities. However, the use of AI in banking is also subject to various regulations, such as anti-money laundering (AML) and know-your-customer (KYC) regulations. Banks must ensure that their AI systems comply with these regulations and provide adequate transparency and explainability of AI decisions to regulators.

Ethical Considerations

AI systems can make decisions that have significant consequences for customers, such as denying credit or insurance. Therefore, banks must ensure that their AI systems are fair, transparent, and unbiased. Ethical considerations also include ensuring that AI systems do not infringe on customers’ privacy or discriminate against certain groups. Banks must establish clear ethical guidelines for AI use and ensure that their AI systems align with these guidelines.

Integration with Legacy Systems

Banks often have legacy systems that are not designed to work with AI systems. Integrating AI systems with these legacy systems can be challenging and time-consuming. Banks must invest in modernizing their IT infrastructure and ensuring that their AI systems can seamlessly integrate with their existing systems.

Talent Shortage

The adoption of AI in banking requires specialized skills, such as data science and machine learning. However, there is a shortage of talent in these areas, making it challenging for banks to find and retain qualified personnel. Banks must invest in training and development programs to upskill their existing workforce and attract talent from outside the organization. Implementing mentorship software can facilitate knowledge transfer and skill development among employees.

Lack of Standardization

There is a lack of standardization in the development and deployment of AI systems in banking. This lack of standardization can lead to inconsistencies in AI performance and hinder the adoption of AI in the industry. Banks must work together to establish standards for AI development and deployment to ensure consistency and interoperability.

Explainability

AI models can be complex and difficult to understand, making it challenging for banks to explain their decisions to customers or regulators. Banks must invest in developing explainable AI models that provide clear insights into how decisions are made. This will help build trust with customers and ensure regulatory compliance.

Also Read: Impact of Generative AI in FinTech Industry: The Future Unveiled

Future of AI in Banking: What's Next?

The future of AI in banking is expected to be characterized by increased integration, enhanced customer experiences, improved risk management, and greater efficiency. Here are some key aspects of what’s next in the field:

1. Enhanced Customer Experience: AI will play a significant role in personalizing customer experiences by analyzing their financial behavior, preferences, and needs. This will lead to more tailored services, such as personalized investment advice, customized loan offers, and proactive fraud detection.

2. Virtual Assistants and Chatbots: AI-powered virtual assistants and chatbots will continue to evolve, providing customers with instant, 24/7 support for various banking tasks, such as account inquiries, bill payments, and transaction history reviews. These tools will become more sophisticated, enabling them to handle complex queries and even provide financial advice.

3. Digital Banking and Mobile Applications: AI will further transform digital banking and mobile applications, making them more user-friendly and efficient. Features like voice recognition, facial recognition, and biometric authentication will enhance security and convenience for customers.

4. Fraud Detection and Prevention: AI-driven fraud detection systems will become more advanced, utilizing machine learning algorithms to analyze patterns and detect anomalies in real time. This will help banks proactively identify and prevent fraudulent activities, protecting both the institution and its customers.

5. Investment and Wealth Management: AI will revolutionize investment and wealth management by providing intelligent investment recommendations based on a customer’s risk profile, financial goals, and market trends. This will lead to more efficient portfolio management and potentially higher returns for investors.

6. Automation and Efficiency: AI will continue to automate various banking processes, such as loan underwriting, credit scoring, and compliance checks. This will result in faster processing times, reduced errors, and increased efficiency, allowing banks to serve their customers better.

7. Open Banking and APIs: The adoption of open banking standards and APIs will enable banks to collaborate with third-party developers and fintech companies, leading to innovative financial products and services. AI will play a crucial role in integrating these diverse systems and ensuring seamless data sharing.

8. Regulatory Compliance: AI will assist banks in maintaining regulatory compliance by monitoring and analyzing vast amounts of data in real time. This will help banks identify potential compliance risks and take proactive measures to address them.

9. Cybersecurity: AI will be instrumental in enhancing cybersecurity measures in the banking sector. It will help in detecting and preventing cyber threats, such as phishing attacks, malware, and data breaches, by analyzing patterns and identifying potential risks.

10. Employee Training and Development: AI will also impact the way banks train and develop their employees. AI-powered tools can provide personalized training programs, assess employee performance, and identify areas for improvement, ultimately leading to a more skilled and efficient workforce.

Conclusion

The impact of AI in banking is transformative, leading to improved efficiency, enhanced customer experience, and increased profitability. While there are challenges associated with AI adoption in banking, the benefits outweigh the drawbacks. With increasing investment in AI research and development, we can expect more innovative applications of AI in banking in the future. As banks continue to leverage AI capabilities, they will be better positioned to meet customer needs and stay competitive in the market.

So, if you are looking to develop a fintech app, contact us. At ToXSL Technologies, we have a team of expert developers who are well-versed in AI algorithms and can help you develop the best fintech app that will help you enhance your business. Request a quote now!

FAQs

1. How is AI transforming the banking sector?

AI is revolutionizing banking by enhancing customer service, automating processes, improving fraud detection, and enabling personalized financial advice. It streamlines operations, reduces costs, and enhances decision-making, ultimately creating a more efficient and secure banking environment.

2. What are the key benefits of AI in banking?

AI offers faster transactions, reduced human error, better risk management, and improved customer experiences. It helps banks personalize services, detect fraudulent activities in real-time, and optimize operations, contributing to increased profitability and customer satisfaction.

3. What challenges do banks face when implementing AI?

Banks may face challenges such as data privacy concerns, integration with existing systems, and the need for skilled personnel. Ensuring AI models are accurate and ethical is also critical to gaining customer trust and maintaining regulatory compliance.

4. Can AI replace human employees in banks?

While AI can automate many tasks, it’s unlikely to fully replace human employees. Instead, it enhances human roles by handling repetitive tasks, allowing staff to focus on more complex, customer-facing, or strategic responsibilities.