- Jan 15, 2026

Share this post on:

The FinTech industry has experienced a transformative shift in recent years with the emergence of generative AI. This innovative technology has enabled financial institutions and startups to develop novel solutions that cater to an increasingly complex and dynamic market landscape. Generative AI has shown immense potential for revolutionizing various aspects of the FinTech industry, from fraud detection and risk management to investment analysis and customer service.

As the name suggests, generative AI refers to a type of Artificial Intelligence that can generate new and original content, such as text, images, music, or even entire conversations. In the context of FinTech, this technology has enabled financial institutions and startups to create innovative products and services that are more efficient, effective, and personalized than ever before.

One of the most significant impacts of generative AI on the FinTech industry is its ability to automate complex and time-consuming tasks. For instance, generative AI can be used to generate financial reports, conduct market analysis, or even create investment proposals. This has not only streamlined operations for financial institutions but also enabled startups to develop innovative products that were previously unfeasible.

In addition, generative AI is enabling the development of new investment products and services. For example, generative AI-powered algorithms can create customized investment portfolios based on an individual's financial goals and risk tolerance, providing a more tailored and effective investment experience.

Key Takeaways

• AI is revolutionizing banking operations by automating tasks, improving efficiency, and reducing costs across customer service, fraud detection, and risk management.

• Enhanced customer experiences through chatbots and personalized financial insights are becoming standard expectations in modern banking.

• AI strengthens security and compliance, but also requires robust data governance and ethical frameworks to manage risks responsibly.

• Integration barriers such as legacy systems, skills gaps, and regulatory complexity remain key hurdles for banks implementing AI.

• Future banking trends will see AI deeply embedded in digital platforms, investment advisory, fraud prevention, and open banking ecosystems, reshaping industry competitiveness.

Impact of Generative AI on the FinTech Industry

Let us dive deep into the article and explore the impact of generative AI on the FinTech industry and how it is transforming traditional banking and investment practices.

1. Automated Content Generation

Generative AI can be used to automate the generation of financial content such as research reports, market analysis, and investment recommendations. This can free up human analysts' time, allowing them to focus on more complex tasks such as strategic planning and decision-making. By leveraging generative AI, FinTech companies can significantly reduce their content creation costs while improving the quality and accuracy of their outputs.

2. Personalized Investment Advisory

Generative AI can be used to create personalized investment advisory services tailored to individual investor's risk tolerance, investment goals, and financial status. By analyzing vast amounts of financial data, generative AI can identify patterns and trends that human analysts may miss. This allows for more informed investment decisions and improved returns for investors. Integrating an investment screener with generative AI further helps investors filter stocks that match their personalized advisory profile, making data-driven decisions faster and more efficiently.

3. Fraud Detection and Prevention

Generative AI can be used to detect and prevent fraudulent activities such as credit card fraud, identity theft, and money laundering. By analyzing patterns of behavior and transaction data, generative AI can identify unusual or suspicious activity and flag it for human review. This can significantly reduce the risk of fraud in the FinTech industry.

4. Natural Language Processing

Generative AI can be used to improve natural language processing (NLP) capabilities in the FinTech industry. NLP is critical for chatbots, voice assistants, and other conversational interfaces that are becoming increasingly popular in banking and investment. Generative AI can help FinTech companies create more sophisticated NLP models that can understand complex financial concepts and provide accurate responses to customer inquiries.

5. Enhanced Customer Experience

Generative AI can be used to enhance the customer experience in the FinTech industry. For example, generative AI-powered chatbots can provide personalized investment advice, answer frequent questions, and help customers with basic transactions such as fund transfers. Additionally, generative AI can be used to create interactive financial tools and games that make learning about personal finance fun and engaging for users.

6. Improved Risk Management

Generative AI can be used to improve risk management in the FinTech industry. By analyzing vast amounts of financial data, generative AI can identify potential risks and provide early warnings to financial institutions. This can help prevent unexpected losses and improve overall financial stability.

7. New Business Models

Generative AI can enable new business models in the FinTech industry. For example, generative AI-powered robo-advisors can offer automated investment management services at a lower cost than traditional financial institutions. Additionally, generative AI can be used to create new types of financial products and services that were previously not possible.

8. Regulatory Compliance

Generative AI can help FinTech companies comply with increasingly complex regulatory requirements. By analyzing large amounts of financial data, generative AI can identify potential compliance issues and provide recommendations for how to address them. This can help FinTech companies avoid costly penalties and reputational damage.

9. Enhanced Decision-Making

Generative AI can be used to enhance decision-making in the FinTech industry. By analyzing vast amounts of financial data, generative AI can identify patterns and trends that may not be apparent to human analysts. This can help financial institutions make more informed investment decisions and improve their overall performance.

10. Ethical Considerations

Finally, it's important to consider the ethical implications of generative AI in the FinTech industry. As with any technology, there are potential risks and challenges associated with its use, such as bias in decision-making or the potential for misuse. FinTech companies must address these issues proactively and ensure that their use of generative AI is responsible and ethical.

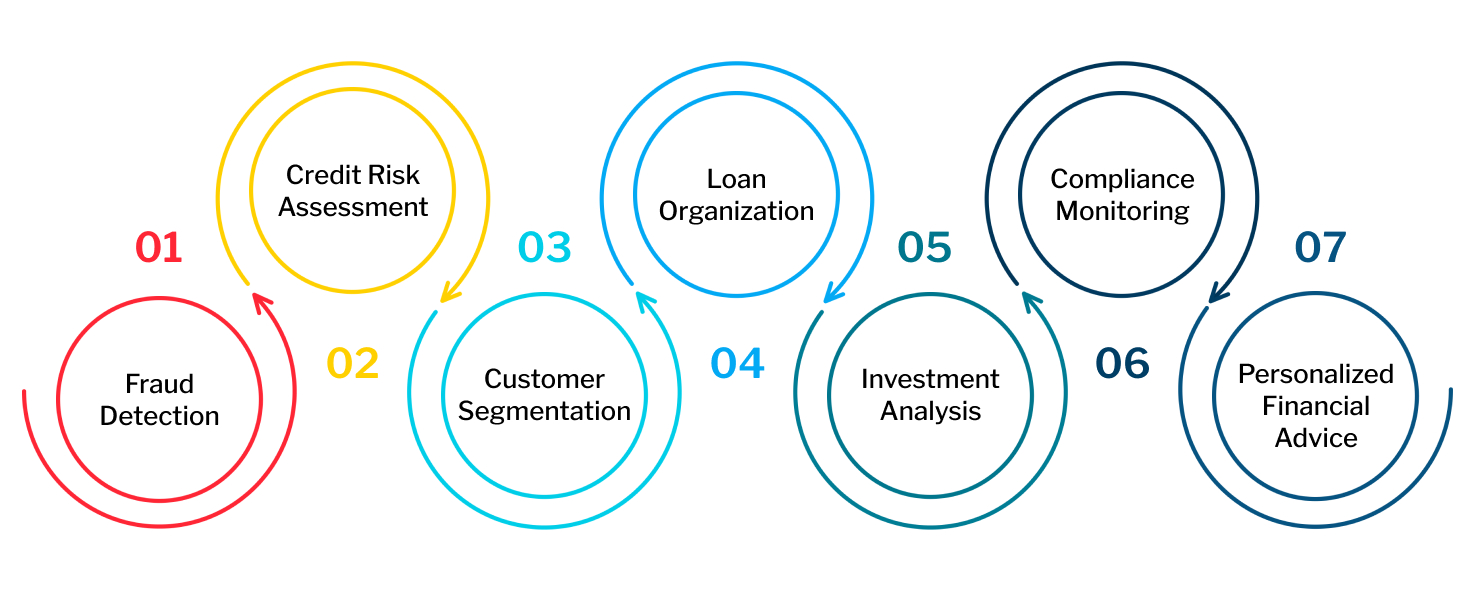

Generative AI in FinTech: Applications

Generative Artificial Intelligence (AI) has been making waves across various industries, and FinTech is no exception. The applications of generative AI in FinTech have the potential to revolutionize the way financial services are delivered, making them more efficient, personalized, and secure. In this blog, we will explore some of the key applications of generative AI in FinTech and discuss the opportunities and challenges associated with their adoption.

1. Fraud Detection

Generative AI can be used to detect fraudulent activities in financial transactions by analyzing patterns in data and identifying anomalies. For instance, generative AI models can be trained to identify unusual spending habits or transaction patterns that may indicate fraudulent activity. By doing so, generative AI can help prevent fraud and reduce the risk of financial loss.

2. Credit Risk Assessment

Generative AI can assist in credit risk assessment by analyzing a wide range of data points, including financial history, credit scores, and social media activity. By using generative AI to identify patterns and connections between different data points, lenders can make more informed decisions about loan approvals and interest rates.

3. Customer Segmentation

Generative AI can help financial institutions segment their customers based on their financial behavior and preferences. By analyzing customer data, generative AI models can identify patterns and characteristics that are unique to each customer group, allowing for more tailored marketing and product offerings.

4. Loan Origination

Generative AI can automate the loan origination process by analyzing borrower data and predicting the likelihood of default. By using generative AI to identify high-risk borrowers, lenders can minimize their exposure to potential losses. Additionally, generative AI can help streamline the loan application process by generating automated loan offers based on the borrower's financial profile.

5. Investment Analysis

Generative AI can assist investors in analyzing market trends and identifying potential investment opportunities. By using generative AI to analyze large amounts of financial data, investors can make more informed investment decisions and improve their overall portfolio performance.

6. Compliance Monitoring

Generative AI can help monitor compliance with financial regulations by analyzing vast amounts of data for potential breaches. By using generative AI to identify compliance issues, financial institutions can minimize the risk of non-compliance and avoid costly fines.

7. Personalized Financial Advice

Generative AI can provide personalized financial advice based on a user's financial history and goals. By using generative AI to analyze a user's financial data, AI models can generate customized investment recommendations tailored to the individual's unique circumstances.

Also Read: How Generative AI is Changing Healthcare Industry

Generative AI in FinTech: Opportunities

Let’s dive deep and learn more about the opportunities offered by Generative AI in FinTech:

1. Improved Efficiency

Generative AI can automate many of the repetitive tasks involved in financial analysis and decision-making, freeing up human analysts to focus on more complex and high-value tasks.

2. Enhanced Customer Experience

Generative AI can help financial institutions deliver personalized products and services tailored to each customer's unique financial goals and preferences.

3. Increased Accuracy

Generative AI models can analyze vast amounts of data and identify patterns that may not be apparent to human analysts, leading to more accurate predictions and decision-making.

4. Improved Risk Management

Generative AI can help financial institutions better manage risk by identifying potential issues before they become major problems.

5. Competitive Advantage

Financial institutions that adopt generative AI will be better positioned to compete in the market, as they will have access to more advanced and accurate data analysis capabilities.

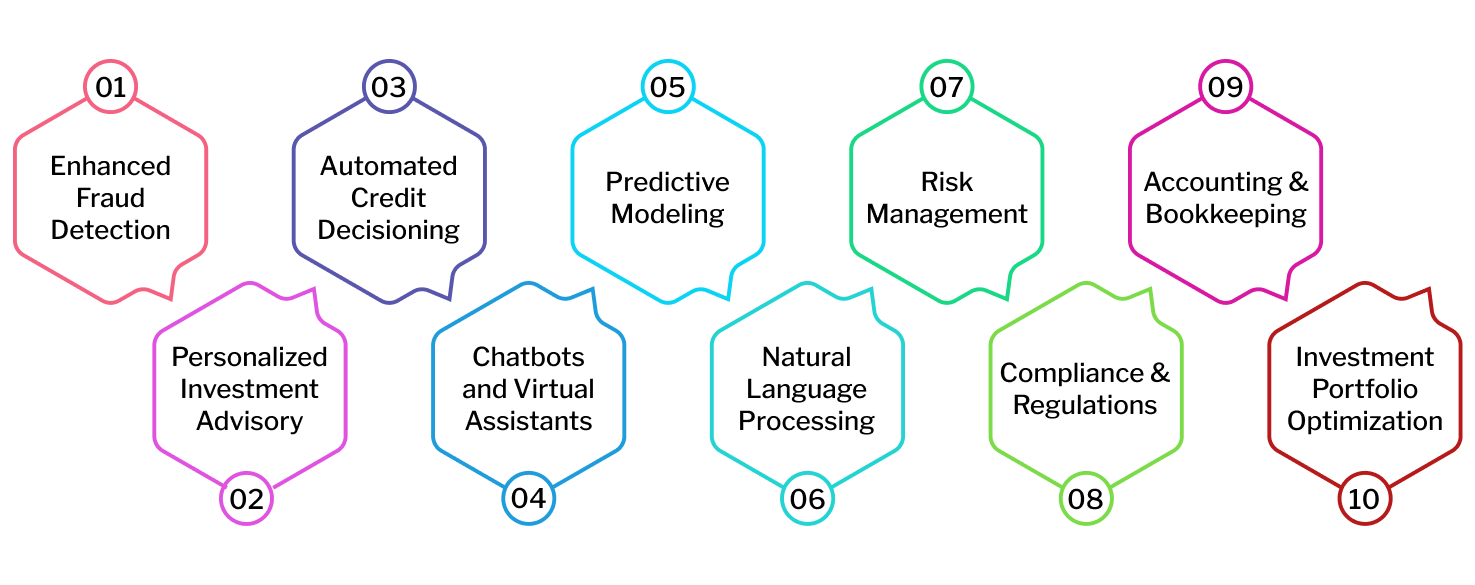

The Future of Generative AI in FinTech: Revolutionizing Banking and Investment

Generative AI has been making waves in various industries, including FinTech. This technology has the potential to transform the financial sector by enhancing decision-making processes, improving customer experience, and reducing costs. In this blog post, we will explore the future of generative AI in FinTech and its implications on banking and investment.

1. Enhanced Fraud Detection

Generative AI can create increasingly sophisticated fraudulent patterns, allowing for more accurate detection and prevention of financial crimes. By analyzing historical data and identifying patterns, generative AI can help identify potential security threats in real time, enabling banks to take proactive measures to prevent fraud.

2. Personalized Investment Advisory

Generative AI can analyze a vast amount of financial data, including market trends, investor preferences, and portfolio performance. By creating a personalized profile for each investor, generative AI can provide tailored investment advice, helping individuals make informed decisions about their investments. This will lead to more efficient allocation of resources and improved investment outcomes.

3. Automated Credit Decisioning

Generative AI can analyze a large volume of financial data, including credit reports, payment history, and demographic information. By identifying patterns and relationships within this data, generative AI can help lenders make more accurate and informed decisions about loan approvals and interest rates. This will lead to a more efficient and fair lending process.

4. Chatbots and Virtual Assistants

Generative AI-powered chatbots and virtual assistants can provide 24/7 customer support, answering frequently asked questions and freeing up human representatives to handle complex queries. By analyzing customer interactions, generative AI can improve the overall customer experience, leading to increased customer satisfaction and loyalty.

5. Predictive Modeling

Generative AI can create complex models that analyze large amounts of financial data, predict market trends, identify potential risks, and determine optimal investment strategies. By providing accurate predictions and recommendations, generative AI can help banks and investors make informed decisions about their investments.

6. Natural Language Processing

Generative AI-powered NLP can analyze vast amounts of unstructured data, including financial news articles, social media posts, and customer feedback. By identifying sentiment and trends within this data, generative AI can provide insights that help banks and investors understand market dynamics and make more informed decisions.

7. Risk Management

Generative AI can analyze vast amounts of financial data, identifying potential risks and providing recommendations to mitigate them. By detecting anomalies and predicting market volatility, generative AI can help banks and investors manage risk more effectively, leading to improved financial performance.

8. Compliance and Regulations

Generative AI can analyze regulatory data and identify potential compliance issues, providing alerts and recommendations to ensure banks are meeting legal requirements. By automating compliance processes, generative AI can reduce the administrative burden on banks, allowing them to focus on core financial services.

9. Accounting and Bookkeeping

Generative AI can analyze financial data and automate accounting and bookkeeping tasks, such as reconciling bank statements, recording transactions, and generating invoices. By streamlining these processes, generative AI can reduce errors, improve accuracy, and free up human resources for more strategic tasks.

10. Investment Portfolio Optimization

Generative AI can analyze vast amounts of financial data, including investor preferences, market trends, and portfolio performance. Generative AI can help investors achieve their financial goals while minimizing risk by creating an optimal investment portfolio.

Conclusion

Generative AI is transforming the FinTech industry by automating content generation, providing personalized investment advisory services, detecting fraud, improving natural language processing capabilities, enhancing customer experience, improving risk management, enabling new business models, and assisting with regulatory compliance.

As technology continues to evolve, FinTech companies must stay ahead of the curve and leverage generative AI to improve their operations and better serve their customers. However, it is crucial to consider the ethical implications of this technology to ensure responsible and ethical use in the industry.

Furthermore, to gain a competitive advantage, it is crucial to integrate Artificial Intelligence into your business. Nevertheless, integrating Artificial Intelligence into your business is a challenging task. Collaborating with ToXSL Technologies, a leading Software Development Company, can aid in this endeavor. Get in touch with us to explore how we can facilitate the implementation of AI into your business and enhance your business strategy.

Frequently Asked Questions

1. How is generative AI impacting the FinTech industry?

Generative AI enhances the FinTech industry by automating tasks like fraud detection, risk analysis, and financial forecasting. It enables personalized financial solutions, streamlines operations, and improves decision-making, driving innovation and efficiency within financial services.

2. What are the key benefits of generative AI in FinTech?

Generative AI offers enhanced data analysis, improved customer service through chatbots, more accurate financial predictions, and automation of routine tasks. It allows FinTech companies to offer personalized, data-driven financial products and services.

3. Can generative AI improve financial security in FinTech?

Yes, generative AI helps detect fraudulent activities by analyzing vast amounts of data in real-time, identifying suspicious patterns, and predicting potential threats. This proactive approach strengthens security and reduces risks for financial institutions.

4. What challenges does generative AI face in the FinTech industry?

Generative AI faces challenges such as regulatory compliance, data privacy concerns, and the need for high-quality data. Integrating AI into existing systems may also require substantial investment and expertise, posing hurdles for some FinTech firms.