- Dec 02, 2022

Share this post on:

With digitalization and the use of mobile apps, the life of every individual has changed. The apps offer ease, are highly convenient, and positively impact businesses.

Health and fitness are crucial goals that everyone needs to take care of. The pandemic has already taught a lesson, and therefore now everyone is making a perfect plan for life & health.

Yes, we are talking about the health insurance industry. People are now aware of how essential health insurance is. And invest in these applications to get all the health benefits.

The insurance application demand continues to rise and covers the expenditure related to COVID-19 treatment and testing. The companies are creating robust, secure, and user-friendly applications that benefit the customers.

There is a lot of competition in the market, and so many startups are investing to develop health insurance applications. But to offer a competitive edge, you require collaborating with a leading mobile app development company to offer maximum benefits to the users.

Market Overview of Health Insurance Applications

Health insurance has now become the need of the hour and is mandatory for everyone. The global health insurance market was around $3,153 billion in 2018, and in 2026 it is estimated to reach an amount of $4,475 billion in the year 2026.

- The pandemic has boosted the sector even more, and there has been a 50% rise in queries related to health policies.

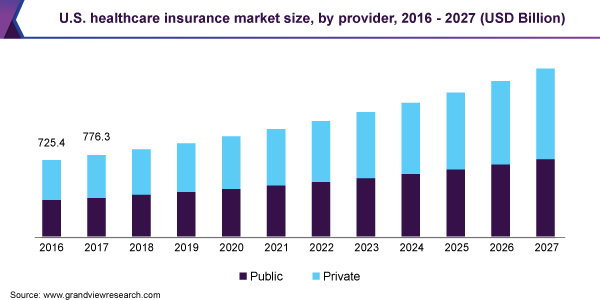

- The United States has the largest health and medical insurance market and will grow at a CAGR of 8.1% through 2024.

- The health insurance industry is growing large, and the sector is adopting the latest technologies and continues to grow.

- As per an analysis from Grand View Research, the health insurance market was US $2.4 trillion in 2019 and is expanding with a CAGR of 6.7%.

What are the challenges faced by Health Insurance Sector?

Health insurance has turned out to be the most profitable sector, but when there are profits, there are challenges too. No one likes to follow the traditional method of dealing with clients. Patients and users are now switching to health insurance mobile applications. It allows them to find all the best insurance plans, doctors, and other things with just a click away. Here are some of the challenges faced by health insurance apps:

- Excess of Documentation and Paperwork

- Unable to find the best doctors

- Long lines of appointment

- Difficult to select the best policy

- Disorganized healthcare system

Why is it time to invest in Health Insurance Applications?

There are a lot of health Insurance Applications in the market. Here are the most crucial advantages offered by such apps:

1. Helps Patients select the right plan

Choosing the right insurance plan that covers everything can be overwhelming for anyone. So with health insurance apps, you can select the most suitable plan while analyzing every detail the plan covers.

The app offers all the features, costs, and benefits of the various plans. It allows the user to choose the plan well suited.

2. Access to Health Insurance Officials

Insurance has always been synonymous with long wait times and long queues for patients to get in touch with an insurance official. Health insurance mobile apps allow better and quicker communication between patients and officials that ultimately saves time & contributes to better customer satisfaction.

3. Quick and Easy Payments

It allows your users to make quick payments without having to stand in long queues. The app offers a secured payment gateway that allows users to make quick payments right from the app. Also, the users can make the necessary changes and customize them as per their needs.

4. Makes the overall healthcare system transparent

With an application in place, all the processes about health insurance are there on a single dashboard. That makes it easier for them to understand all the details. Customers can enjoy the benefits and see what is going on once their application is accepted.

How to create a Health Insurance App?

To create a health insurance mobile application, here are the essential factors you require to consider. Let us discuss one by one:

1. Know your target market

No matter what plans you are offering, you should be able to address issues that create trouble for your target audiences. If you fail to do so, you will not be able to succeed and retain the audience.

2. Give the audience what they look for

Try to solve all the issues the customers face. Digitalization offers crucial benefits that solve most of the user issues like making payments, standing in long queues, communicating, paperwork, and a lot more.

3. Analyze the market before making critical steps

Before developing an app, you must analyze the market and know what's trending that minimizes the risk. Analyzing your competitors helps to achieve the aim.

4. Awesome UI/UX

To simplify complicated tasks, you must have a smart solution. Therefore, offering the users an incredible UI/UX creates a positive environment and encourages user retention.

5. Do not forget to test your product

You should always check if your users feel comfortable with your digital solution, and therefore testing plays a crucial role.

Features of a Health Insurance App

To gain a competitive edge, you must be able to offer your users all the features. Therefore, the users need to transform and offer essential features in the app.

Here are the most crucial features to add:

1. Creating a Profile

The application has a profile section where you can find all the details of the insured person.

2. Offer Suitable Plans

It is another crucial step that allows the users to check and choose the best suitable plan as per their needs. When an app is designed with all the crucial information, the choice becomes easier. Let us take an example, ask questions to the users so that you can gather the details of what the users want and offer them what they require.

3. Purchasing or Renewing Policies

The app allows the user to make the best decision. One of the great benefits it offers is that users here can purchase and renew their policies whenever in need.

4. Easy Payment Option

The digital platforms allow easy payment options online so that the user does not face any penalties on delayed payments. Integrating a secured payment gateway reduces the fear of losing coverage on the policy.

5. Finding the Best Doctors

Here, the users can get a complete list of specialist doctors that allows them to choose the illness of the patient.

6. Booking an Appointment

No longer, do the users have to stand in long queues. Therefore, a user-friendly calendar with easy navigation can help users to book their appointment based on the availability of dates and time slots.

7. Symptom Checker

A simple questionnaire or form can inquire about the patient's health. Based on that; they can contact a specialist doctor. It will also help in pre-diagnosis and save the time of doctors and the patient at the time of appointment.

With a simple form or a questionnaire, the user can enquire about the health of the patient.

8. Document Access

The health insurance apps store all the documents and details related to the policies and their reports. So there is no need to carry out papers and fetch reports. Rather, with a single tap on the phone, you can fetch all the reports. Also, all the user documents are kept safe and secure.

9. Push Notifications

By adding the option of push notifications, the app offers reminders to the users and updates about their next doctor visit, renew insurance, and more. Notifications are sent to the users with all the details.

10. FAQs

Integrating a section of FAQs, allows the users to clear up their minds and ask questions anytime they want regarding these policies and other scenarios.

11. Support Team

Patients and users purchasing or renewing health insurance policies can easily talk to the support teams anytime they want.

Cost to Develop a Feature-Rich Insurance App

The cost of developing a health insurance app is not fixed. It depends on various factors, and that includes:

- The complexity of Apps and Features included

- Preferred Platform (iOS, Android, or both)

- Location for app development

- Number of hours invested

- The team you hire

Winding-up

Hope you are satisfied with all the information and details. If you are looking forward to developing your own health insurance mobile application, you are at the right place. ToXSL Technologies is a leading mobile app development company, that has expertise in successful medical services digitalization and customization.