- Oct 29, 2025

Share this post on:

The digital revolution has transformed how banks operate, connect, and deliver value to customers. At the heart of this evolution lies API integration a game-changing innovation that bridges traditional banking with modern fintech ecosystems. Through APIs, financial institutions can deliver faster, more secure, and personalized digital experiences, ensuring agility in an increasingly competitive environment.

The banking sector is undergoing a dramatic digital transformation powered primarily by Application Programming Interfaces (APIs). Statistics reveal that by 2025, 90% of financial institutions worldwide will rely on APIs to enhance customer experiences. Global investments in APIs within financial services reached $24 billion, and are expected to grow 15% annually. APIs now drive 40% of revenue growth in leading financial institutions by enabling seamless integration and personalized services.

So, what are the essential building blocks of API integration that make this transformation possible? How are these APIs revolutionizing business banking in the digital age? And how can banks leverage them to stay competitive?

Key Takeaways

1. With API integration, businesses can automate various financial processes, eliminating the need for manual interventions. This leads to reduced errors, faster transactions, and greater overall efficiency. By streamlining operations, businesses can improve their internal workflows and focus more on growth and innovation.

2. By leveraging cutting-edge API integration, ToXSL Technologies helps businesses stay ahead in the rapidly evolving world of digital banking. Our API solutions enable businesses to offer more innovative services, improve their operational agility, and adapt to the ever-changing demands of the financial sector.

3. ToXSL Technologies offers expert API integration services, connecting businesses seamlessly with bank like ICICI. This integration allows businesses to tap into a range of banking services, including loans, payments, trade finance, and account management, all through reliable and secure APIs.

4. With API integration, businesses can automate various financial processes, eliminating the need for manual interventions. This leads to reduced errors, faster transactions, and greater overall efficiency. By streamlining operations, businesses can improve their internal workflows and focus more on growth and innovation.

Understanding API Integration in Business Banking

APIs act as digital connectors that enable different software applications to communicate and exchange data seamlessly. In business banking, APIs connect core banking systems with various fintech services, third-party applications, and customer platforms to provide comprehensive financial solutions. Key attributes enabling this integration include:

Integration and Interoperability: APIs allow diverse banking services and third-party applications to interact as a cohesive ecosystem.

Scalability: APIs decouple services, allowing individual components to scale without disrupting the entire system.

Flexibility and Adaptability: APIs facilitate the continuous evolution of banking services by allowing updates to individual components without system-wide changes.

Automation: APIs automate routine data exchange and transactions, increasing efficiency and reducing manual errors.

Security: Properly designed APIs provide controlled entry points with robust security protocols, ensuring safe data access.

The Impact on Business Banking

API integration is fundamentally reshaping business banking by enabling seamless, real-time access to integrated financial data, enhancing operational efficiency, reducing errors, and significantly improving customer satisfaction. Instead of operating as isolated service providers, banks have evolved into digital platforms offering ecosystems of interconnected services that empower SMEs with comprehensive financial management tools.

ToXSL Technologies plays an important role in this transformation with its extensive API integration services. The company offers specialized integration of Loans and Cards APIs, Accounts and Deposits APIs, Payment and UPI APIs, Trade Services APIs, and a broad range of business banking APIs. These services connect businesses to major Indian banks such as SBI, ICICI, HDFC, Axis, PNB, and Kotak Mahindra Bank, among others.

This diverse bank integration portfolio enables clients to leverage reliable, scalable, and secure banking functionalities, facilitating smooth payment processing, loan management, account operations, and trade finance capabilities through unified API-driven solutions.

By bridging fintech innovations with traditional banking, ToXSL Technologies empowers businesses to streamline their financial workflows and adapt dynamically to the digital age.

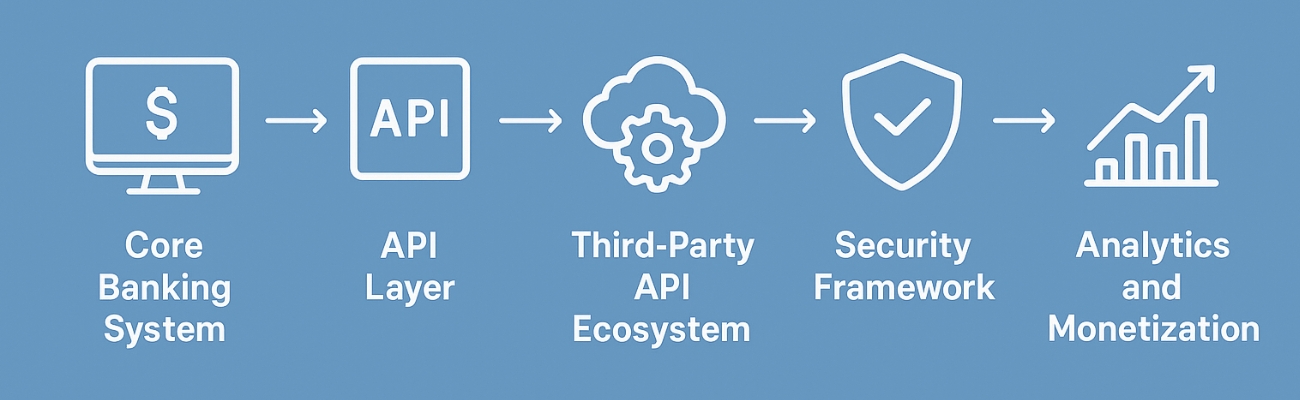

Building Blocks of API Integration for Business Banking

Let us shed some light on the core building blocks of API integration for business banking.

Core Banking System API Layer: The foundational block is the API layer that connects the legacy or core banking system with external and internal services. This layer extracts data and exposes it through secure and standardized APIs, enabling banks to offer real-time account information, transaction processing, payments, and lending functionalities.

Third-Party API Ecosystem: Open banking APIs allow third-party fintechs to access banking data to offer innovative services like cash flow forecasting, automated invoicing, or integrated foreign exchange risk management. This creates value-added services that elevate the SME banking experience, such as unified dashboards with real-time insights, payment scheduling, and proactive lending offers.

API Management Tools: Providing comprehensive documentation, usage guidelines, and sandbox environments through developer portals facilitates efficient onboarding and use of APIs by fintech developers. API management platforms offer monitoring, analytics, traffic control, versioning, and lifecycle governance to ensure scalability, stability, and accountability.

Security Framework: Given the sensitive nature of financial data, API integration must embed stringent security measures—authentication, encryption, and regulatory compliance tools, which minimize risks and streamline compliance processes. 30% adoption increase of RegTech APIs in 2023 highlights their importance in meeting evolving regulatory demands.

Analytics and Monetization: Monitoring API usage with analytics helps banks understand customer behavior, optimize API performance, and assess ROI metrics. Monetization models such as premium services, pay-per-use APIs, or bundled offerings are becoming a critical revenue stream for API-driven banks, fostering sustainable growth.

Benefits of Using APIs in Fintech

APIs (Application Programming Interfaces) have become a backbone technology in the fintech sector, unlocking countless opportunities and transforming how financial services are delivered to businesses and consumers. Here are the key benefits of leveraging APIs in fintech:

Cost-Effectiveness and Efficiency: APIs allow banks and fintech companies to offer a broad range of services without investing heavily in building and maintaining complex infrastructure from scratch. By integrating pre-built APIs for payments, loans, account management, and more, companies optimize resource use and reduce operational costs. This enables faster, scalable service delivery while minimizing expenses related to compliance and infrastructure development.

Enhanced Customer Experience: Using APIs, fintech companies can provide real-time access to financial data, seamless payment processing, and personalized financial tools. APIs enable unified platforms where customers can manage accounts, loans, payments, and investments across multiple institutions effortlessly. This improved accessibility and convenience led to increased customer satisfaction and loyalty.

Support for Innovation: APIs foster a modular development environment. Fintech firms can easily combine multiple APIs to build innovative financial products and services quickly. This accelerates the time to market for new features and allows continuous enhancement without full system overhauls. Opening up banking data through APIs has catalyzed the rise of embedded finance and open banking, empowering novel business models.

Improved Security and Compliance: Modern fintech APIs incorporate robust security protocols, including encryption, multi-factor authentication, and consent management. These features protect sensitive financial data and help firms adhere to evolving regulatory standards such as PSD2. APIs also facilitate transparent, auditable data sharing between banks and third parties, enhancing trust and compliance.

Seamless Data Sharing and Collaboration: APIs enable secure and efficient data exchange between banks, fintechs, and other stakeholders, enhancing collaboration. This openness allows for richer data-driven insights and personalized solutions, such as credit scoring using alternative data or AI-powered risk assessments. Customers retain control over what data is shared and with whom, increasing transparency.

Scalability and Flexibility: Fintech APIs handle high volumes of transactions and requests, allowing businesses to scale services as demand grows. The flexible nature of APIs supports the integration of new functionalities or third-party services without disrupting existing systems. This adaptability is essential in the fast-changing fintech landscape.

Types of APIs in FinTech

Various types of APIs are instrumental in powering the fintech ecosystem, enabling seamless connectivity, secure data exchange, and innovative financial services. Below is a detailed explanation of the predominant types of fintech APIs, their functions, and significance in modern financial technology:

API Type | Purpose | Fintech API Examples |

|---|---|---|

Payment Processor APIs | Facilitate real-time, secure money transfers and transaction processing | Stripe, PayPal, Razorpay |

Open Banking APIs | Allow third-party applications to access banking data with user consent | TrueLayer, Tink, Nordigen |

Financial Data Aggregator APIs | Consolidate financial data from multiple sources to provide unified views | MX, Salt Edge, Envestnet |

KYC (Know Your Customer) APIs | Verify user identity for onboarding and regulatory compliance | Onfido, Jumio, Trulioo |

RegTech APIs | Support regulatory compliance through transaction monitoring and audit trails | Alloy, ComplyAdvantage, IDnow |

Credit Scoring & Lending APIs | Evaluate creditworthiness and streamline lending workflows | Experian, CredoLab, FinBox |

Investment APIs | Enable portfolio management, real-time market data access, and trading | Alpaca, Robinhood, DriveWealth |

Currency & Crypto Exchange APIs | Support cryptocurrency trading, wallet management, real-time pricing, and currency exchange | Coinbase, CoinMarketCap, CurrencyLayer |

Insurance APIs | Connect fintech platforms with insurers for quotes, policy management, and claims processing | Lemonade, Trov, Cover Genius |

Fraud Detection APIs | Monitor transactions and user behavior to detect and prevent fraud | Sift, Socure, Riskified |

Accounting APIs | Automate bookkeeping, tax calculations, and financial reporting | QuickBooks, Xero, Zoho Books |

AI-powered Fintech APIs | Leverage artificial intelligence for predictive analytics, customer engagement, and risk prevention | Arya.ai, IBM Watson AI |

Challenges of Implementing FinTech APIs

While fintech APIs unlock tremendous potential for innovation, efficiency, and customer engagement, their implementation also presents several significant challenges for financial institutions and technology providers:

Security Risks and Compliance: APIs handle sensitive financial and personal data, making them prime targets for cyberattacks. Ensuring robust authentication, encryption, and data protection measures is critical yet complex. Regulatory compliance demands, such as GDPR, PSD2, and data localization laws, add further complexity. Failure to meet these standards can result in severe penalties and loss of customer trust. Implementing security by design (DevSecOps) and ongoing vulnerability testing are essential but require dedicated expertise and resources.

Balancing Innovation: Fintech firms struggle to balance rapid innovation with strict and evolving regulatory requirements. Compliance is not just a box-checking exercise but requires continuous monitoring, consent management, audit trails, and reporting. Since regulations can vary by geography and evolve swiftly, maintaining compliant yet agile APIs is a significant challenge, especially for global fintech solutions.

Over-engineering and Complexity: Over-engineering APIs, such as building overly complex and multifunctional systems can make maintenance difficult and slow down development cycles. Simplifying API design to meet core business needs while allowing future scalability demands thoughtful architecture. Complexity can also lead to integration delays and technical debt.

Scalability and Performance: Fintech APIs must handle high transaction volumes and concurrent requests without degradation in performance. Poorly designed or inadequately tested APIs can cause slowdowns or downtime, impacting user experience and trust. Ensuring scalability and load balancing from day one is challenging but vital.

Authentication Failures: APIs often use token-based authentication (OAuth, JWT, API keys). Expired or misconfigured tokens can cause cascading failures in production environments, impacting critical financial operations. Managing token lifecycle properly, including automated refresh mechanisms, secure storage, and monitoring, is important but frequently mishandled.

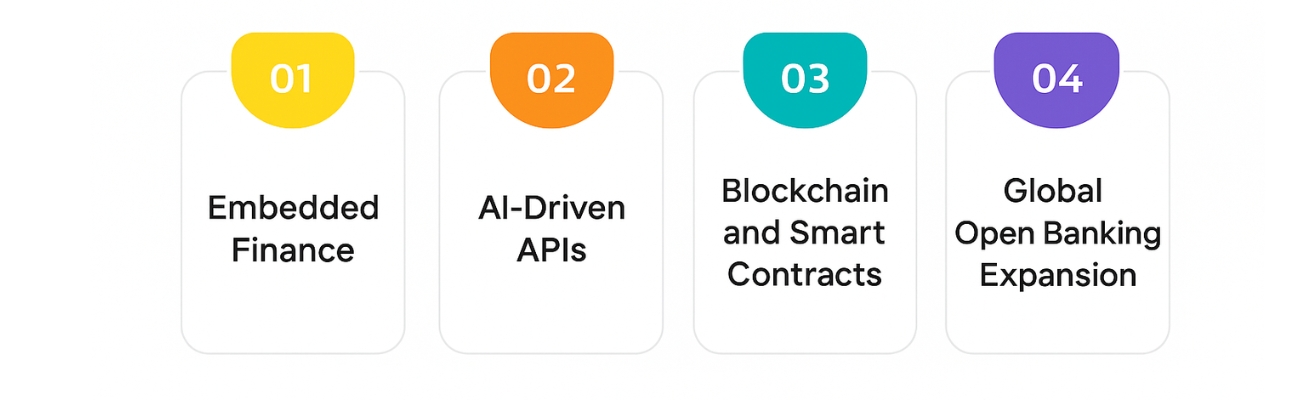

Future Trends in API Integration

The future of business banking lies in open, intelligent, and interoperable APIs. Key trends include:

Embedded Finance: Integrating financial services directly within business applications.

AI-Driven APIs: Leveraging artificial intelligence for predictive analytics and customer personalization.

Blockchain and Smart Contracts: Enabling transparent, secure, and traceable financial transactions.

Global Open Banking Expansion: Standardizing APIs across borders for seamless international banking.

Conclusion

At ToXSL Technologies, we recognize that API integration is a cornerstone of modern business banking. Our commitment is to empower financial institutions to embrace a future-ready, API-driven ecosystem. By leveraging cutting-edge API strategies, we help banks and fintechs unlock innovation, operational agility, and an enhanced customer experience. Together, we are powering the digital age of business banking, where seamless connectivity, security, and scalability redefine how financial services are delivered.

Frequently Asked Questions

1. What is API integration in business banking?

API integration in business banking refers to the use of Application Programming Interfaces (APIs) to connect banking systems with third-party applications and fintech services. This enables seamless data exchange, real-time transactions, and automated workflows across platforms, improving operational efficiency and customer experience.

2. Why are APIs important for digital business banking?

APIs enable banks and fintech firms to offer flexible, scalable, and personalized financial services quickly. They unlock open banking models, improve security through controlled data sharing, and foster innovation by allowing developers to build on existing banking infrastructure without starting from scratch.

3. What are the core building blocks of API integration in business banking?

The core building blocks include:

Core banking system API layers that expose banking functionalities

Open banking and third-party API ecosystems for enhanced services

Developer portals and API management tools for documentation, monitoring, and governance

Security and compliance frameworks ensuring regulatory adherence

Analytics and monetization tools for optimizing API usage and generating revenue

4. How does API integration impact business banking customers?

API integration offers customers a unified, convenient banking experience with real-time access to accounts, payments, loans, trade services, and more. It enables SMEs to manage finances from unified dashboards, automate transactions, and access innovative credit and payment options.

5. How does ToXSL Technologies contribute to API integration in business banking?

ToXSL Technologies provides specialized API integration services connecting various banking functionalities such as Loans and Cards APIs, Accounts and Deposits, Payments and UPI, Trade Services, and Business Banking APIs. They integrate with major Indian banks like SBI, ICICI, HDFC, Axis, PNB, and Kotak, delivering secure and scalable solutions for fintech and financial institutions.